A hard disk drive (HDD), commonly referred to as a hard drive, hard disk, or fixed disk drive, is a non-volatile storage device which stores digitally encoded data on rapidly rotating platters with magnetic surfaces. Strictly speaking, "drive" refers to a device distinct from its medium, such as a tape drive and its tape, or a floppy disk drive and its floppy disk. Early HDDs had removable media; however, an HDD today is typically a sealed unit (except for a filtered vent hole to equalize air pressure) with fixed media.

Originally, the term "hard" was temporary slang, substituting "hard" for "rigid", before these drives had an established and universally-agreed-upon name. A HDD is a rigid-disk drive although it is rarely referred to as such. By way of comparison, a so-called "floppy" drive (more formally, a diskette drive) has a disc that is flexible. Some time ago, IBM's internal company term for a HDD was "file".

HDDs (introduced in 1956 as data storage for an IBM accounting computer) were originally developed for use with general purpose computers; see History of hard disk drives.

In the 21st century, applications for HDDs have expanded to include digital video recorders, digital audio players, personal digital assistants, digital cameras and video game consoles. In 2005 the first mobile phones to include HDDs were introduced by Samsung and Nokia. The need for large-scale, reliable storage, independent of a particular device, led to the introduction of configurations such as RAID arrays, network attached storage (NAS) systems and storage area network (SAN) systems that provide efficient and reliable access to large volumes of data. Note that although not immediately recognizable as a computer, all the aforementioned applications are actually embedded computing devices of some sort.

Technology

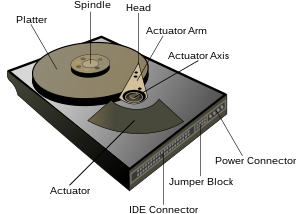

HDDs record data by magnetizing ferromagnetic material directionally, to represent either a 0 or a 1 binary digit. They read the data back by detecting the magnetization of the material. A typical HDD design consists of a spindle which holds one or more flat circular disks called platters, onto which the data are recorded. The platters are made from a non-magnetic material, usually aluminum alloy or glass, and are coated with a thin layer of magnetic material. Older disks used iron(III) oxide as the magnetic material, but current disks use a cobalt-based alloy.

A cross section of the magnetic surface in action. In this case the binary data is encoded using

frequency modulation.

The platters are spun at very high speeds (details follow). Information is written to a platter as it rotates past devices called read-and-write heads that operate very close (tens of nanometers in new drives) over the magnetic surface. The read-and-write head is used to detect and modify the magnetization of the material immediately under it. There is one head for each magnetic platter surface on the spindle, mounted on a common arm. An actuator arm (or access arm) moves the heads on an arc (roughly radially) across the platters as they spin, allowing each head to access almost the entire surface of the platter as it spins. The arm is moved using a voice coil actuator or (in older designs) a stepper motor. Stepper motors were outside the head-disk chamber, and preceded voice-coil drives. The latter, for a while, had a structure similar to that of a loudspeaker; the coil and heads moved in a straight line, along a radius of the platters. The present-day structure differs in several respects from that of the earlier voice-coil drives, but the same interaction between the coil and magnetic field still applies, and the term is still used.

Older drives read the data on the platter by sensing the rate of change of the magnetism in the head; these heads had small coils, and worked (in principle) much like magnetic-tape playback heads, although not in contact with the recording surface. As data density increased, read heads using magnetoresistance (MR) came into use; the electrical resistance of the head changed according to the strength of the magnetism from the platter. Later development made use of spintronics; in these heads, the magnetoresistive effect was much greater that in earlier types, and was dubbed "giant" magnetoresistance (GMR). This refers to the degree of effect, not the physical size, of the head — the heads themselves are extremely tiny, and are too small to be seen without a microscope. GMR read heads are now commonplace.

HD heads are kept from contacting the platter surface by the air that is extremely close to the platter; that air moves at, or close to, the platter speed. The record and playback head are mounted on a block called a slider, and the surface next to the platter is shaped to keep it just barely out of contact. It's a type of air bearing.

The magnetic surface of each platter is conceptually divided into many small sub-micrometre-sized magnetic regions, each of which is used to encode a single binary unit of information. In today's HDDs, each of these magnetic regions is composed of a few hundred magnetic grains. Each magnetic region forms a magnetic dipole which generates a highly localized magnetic field nearby. The write head magnetizes a region by generating a strong local magnetic field. Early HDDs used an electromagnet both to generate this field and to read the data by using electromagnetic induction. Later versions of inductive heads included metal in Gap (MIG) heads and thin film heads. In today's heads, the read and write elements are separate, but in close proximity, on the head portion of an actuator arm. The read element is typically magneto-resistive while the write element is typically thin-film inductive.

In modern drives, the small size of the magnetic regions creates the danger that their magnetic state might be lost because of thermal effects. To counter this, the platters are coated with two parallel magnetic layers, separated by a 3-atom-thick layer of the non-magnetic element ruthenium, and the two layers are magnetized in opposite orientation, thus reinforcing each other. Another technology used to overcome thermal effects to allow greater recording densities is perpendicular recording, first shipped in 2005, as of 2007 the technology was used in many HDDs.

See File System for how operating systems access data on HDDs and other storage devices.

![[Sunw]](http://stockcharts.com/images/minilink_sc.gif)